How Madoff did it

In an earlier entry, I asked how Bernard Madoff, over a 20 year period, could have kept receiving enough new investments from new clients to pay the ever-increasing “dividends” he owed to all his clients. A reader has worked it out.

Leonard D. writes:

If you put some numbers on it, the Madoff scheme makes a lot more sense. For reference, see the Wikipedia page on it.

Madoff claims he only “went Ponzi” in the early ’90s, although this is probably a lie to shield his family. My completely uninformed guess is he did it in the late ’80s, perhaps after the “Black Monday” crash in 1987. So, in that case the thing unraveled 21 years after it began.

One aspect of it not much talked about, is that the $65 billion figure includes the reinvestment of the improbably high returns that Madoff was promising his investors. Much less money was given to him; “former SEC Chairman Harvey Pitt estimated the actual fraud at between $10 and $17 billion.” So he was taking in on the order of a billion dollars per year during the fraud’s run.

One thing Madoff did was focus on getting charity investors. Because of federal rules, charities tend to invest, then take out a flat five percent per year. Thus, a crook can string them along for 20 years, minus time for interest which he is supposedly earning for them. But many other investors simply left all of their money with Madoff, and never withdrew any of it.

Finally, it’s worth noting that although Madoff’s returns were improbably good, they were not unbelievably good, just very high and unbelievably consistent. He seems to have averaged roughly 12-16 percent per year, in his supposed returns. This is considerably better than the market or any other investment you could make, but it’s less than most Ponzi schemes.

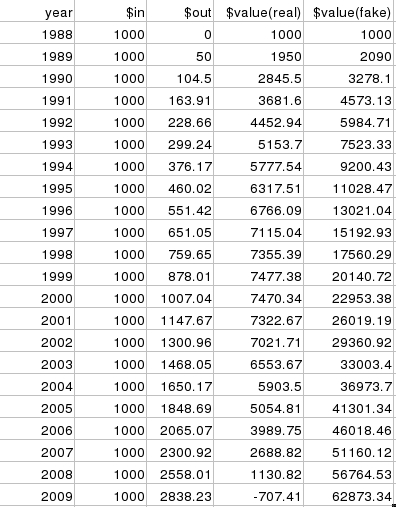

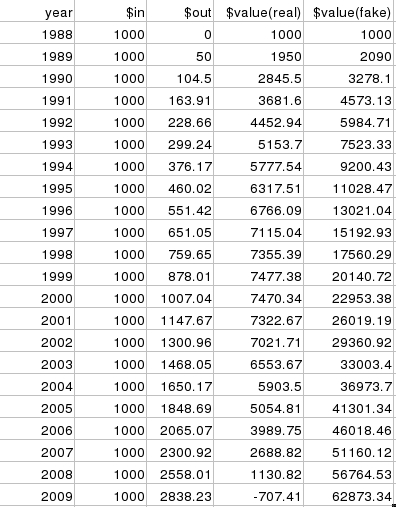

So let us assume that Madoff could get in $1 billion in new investments each year. And let’s assume that all investors withdraw five percent of their investment per year. And assume that no actual investment happens; Madoff just banks the money, getting 0 percent on it. Plugging these numbers into a spreadsheet, I find that if I assume Madoff’s average (fake) return was 14 percent, the numbers come out about right.

Then we get a spreadsheet that looks like this. Dollar numbers are in millions:

What you can see here is that a total of $22b goes in, and all of it is paid out, mostly in the final few years of the scam as the (fake) total value of the fund has increased dramatically.

- end of initial entry -

MG writes:

You wrote:

“month after month for twenty years, he had to keep receiving enough funds in new investments to pay the ever-increasing “dividends” due to all his existing investors including the new ones.”

No, This is the easiest question to answer in the Madoff affair .

Most investors probably had an automatic reinvestment option, so imaginary gains from imaginary trades and imaginary dividends were “reinvested” in Madoff’s fund. Occasional withdravals could be easily paid from previously invested money. Of course invested funds were reduced by Madoff’s withdrawals for his personal needs.

As long as Madoff was not too greedy, he probably diverted to his use only a fraction of $50 to $60 billion, allowing his operation to continue. I say a fraction because it is much harder to hide $20-$30 billion in stolen funds than a few hundred million dollars he probably stole.

What probably caused the end of this scheme was the 50 percent down bear stock market. Client withdrawals increased dramatically and Madoff run out of options.

I don’t buy that he was the only one who knew about fraud. I will bet my house that wife and sons were in too. It was a family decision to let old man to fall on his sword and preserve stolen money for children and grandchildren.

March 15

Kristor writes:

The thing I can’t figure out is how Madoff pulled this off operationally. The financial part is easy, as Leonard D. has shown. The hard part is cranking out fake statements month after month that look plausible. I am managing shareholder of a small investment advisory firm—about 1/65th as big as Madoff’s, in terms of the assets we supervise (albeit that all ours are real)—and I can tell you that it is non trivial even to prepare legitimate, accurate statements that derive almost entirely from data files downloaded to us from third party broker/dealers such as Schwab or Fidelity. That is, even though most of the procedures needed to generate the statements are automated, it still takes many hours each quarter to prepare and mail the statements; numerous employees are involved in the process.

When we prep statements, we push a button in our database and they all print. We audit them for accuracy, and collate, bind, mail, and so forth. But really most of it is done for us by the machine. Even so it is a ton of work. Madoff, by contrast, had to make up every investor’s statement from whole cloth, making sure that each statement for a given client correlated with the statements he had been receiving. The work involved had to have been phenomenal. I see no way that one person could do it alone. This doesn’t even get into the whole problem of making up accounting records for the advisory firm, filing tax returns, K-1s, and so forth.

This on top of running a legit broker/dealer and a legit market maker? And on top of making up all the compliance paperwork needed for the SEC? And on top of the selling? No. The way I see it, Madoff had to have the full-time help of about 10 people, minimum, just for the activities of the investment advisory firm.

LA replies:

Yes, it’s a thing of staggering complexity. Ten people minimum. Meanng it went way beyond his family. That entire business was a criminal enterprise. That’s been obvious from the start but I haven’t seen the media discuss it, the nuts and bolts of how it was done.

Leonard D. writes:

No doubt there were many people in Madoff’s employee. But I doubt most of them were criminal.

Criminal conspiracies are hard to hide. I would not be at all surprised to find out that Madoff’s family was in on it, particularly his wife and his brother, Peter, who was supposedly the only person permitted to audit. I would also be surprised if there was not at least some professional negligence on the part of some of Madoff’s associates, i.e. David Friehling, the supposed accountant for Madoff’s firm. But I don’t see that a guy like that would have had to know what was really going on. Like many others, he had reason to be suspicious, but he may have believed that Madoff’s secrecy was hiding the shady methods he was using to generate his returns (i.e. frontrunning trades).

(That’s one of the novel dynamics in this sordid story, how the Big Crime was not looked for because everyone was focusing on the Small Crime. From one side, many of Madoff’s savvier investors seem to have assumed he was using his insider status to cheat, thus explaining his returns. On the outside, the SEC was sniffing around all the time, but always apparently looking for minutae, which Madoff would then agree to correct.)

I would like to hear more from Kristor on this, since what he has to do for his job is pretty close to what Madoff was doing. But from what Kristor describes, Madoff would have had a much easier time than he does. Madoff would never need to prepare statements based on information from outside (i.e. “downloaded to us from third party broker/dealers such as Schwab or Fidelity”). There were none. All the supposed trades happened in house, and of course, they never actually happened.

I imagine the general operation was this: each month, Madoff would sit down and backproject some trades (hindsight is 20/20!). He would make up days on which he supposedly bought and sold each position. That information could then be given to the normal employees, and they do the normal stuff with it. i.e. turning it into customer statements, tax compliance docs, etc.

Ben W. writes:

Madoff’s assets are over $600 million, not $60 million as previously reported. Those should be seized and suffering victims compensated. There is a 91 year old man who was forced to return to work because of Madoff. People like that should be taken care of from the disbursement of Madoff’s assets.

Posted by Lawrence Auster at March 13, 2009 01:45 PM | Send